Automobile and Parts

New Energy Vehicle Charging Pile Manufacturing Project of Yanbian Prefecture

1. Introduction to the Project

1.1 Project background

1.1.1 Introduction to the Project

As an important direction of global automobile industry transformation, the new energy vehicles industry has been developing rapidly in recent years. With the increasing focus of governments worldwide on environmental protection and technological advancements, new energy vehicles have gradually become one of the mainstream choices in the automotive market. As an essential part of the new energy vehicle ecosystem, the charging pile industry has seen a growing demand for charging piles with the rapid development of the new energy vehicle sector.

1.1.2 Market prospect

(1) Market size of new energy vehicles

In recent years, the scale of the global new energy vehicle market has shown a trend of continuous growth. In 2023, the global sales volume of new energy passenger vehicles reached 13.69 million, with a year-on-year growth of 35%.

In the future, driven by the promotion of environmental protection awareness, policy support and technological progress, the new energy vehicle market is expected to continue to develop rapidly. According to relevant forecasts, the global sales volume of new energy vehicles is expected to exceed 47 million by 2030, corresponding to a compound annual growth rate (CAGR) of more than 20% from 2022 to 2030.

China occupies an important position in the field of global new energy vehicles and has become the world's largest NEV market for several consecutive years. In the first half of 2024, China's production and sales of new energy vehicles reached 4.929 million and 4.944 million units, respectively, with year-on-year growth of 30.1% and 32%, achieving a market share of 35.2%. By the end of June, the cumulative production and sales of domestic new energy vehicles exceeded 30 million. According to the statistics from China Association of Automobile Manufacturers, the sales volume of new vehicles (including exports) in China in 2024 are expected to grow by 3% compared to 2023, reaching approximately 31 million units. Of this total, sales of new energy vehicles are projected to be about 11.5 million units this year.

From January to July 2024, China's new energy vehicles accounted for 65.5% of the global market share, far ahead of other countries. In the field of pure electric vehicles, China's global market share reached 61% in 2023 and maintained a stable performance of 59% in the first half of 2024. In terms of plug-in hybrid models, China's market share increased from 69% in 2023 to 74% in the first half of 2024, demonstrating China's strong competitiveness in this area.

In terms of development speed, China's new energy vehicles industry is growing rapidly. On the one hand, the domestic market demand is strong, and the acceptance of new energy vehicles by consumers is constantly increasing; On the other hand, the strong support of the policy also plays a crucial role, including subsidy policies, car purchase incentives, and the construction of charging infrastructure. In addition, China's new energy vehicle enterprises have been continuously increasing their investment in technological innovation and product development, which has driven the rapid growth of the industry.

(2) Market Scale and Prospect Analysis of New Energy Charging Pile

With the rapid development of the new energy vehicles industry, the demand for charging piles is also increasing. Under the dual promotion of policies and subsidies, the construction speed of charging piles is obviously accelerated. In recent years, the ratio of vehicles to piles (the ratio of new energy vehicles to the number of charging piles) has been maintained at the level about 3:1. According to the plan of the Ministry of Industry and Information Technology, the domestic vehicle-to-pile ratio will be 2:1 in 2025. By 2030, it will achieve 1:1. In 2023, the market scale of China's charging pile reached 43.1 billion yuan, and by 2024, the market scale is expected to reach approximately 51.7 billion yuan.

As of December 2023, the number of public piles is 2,726,000, with a year-on-year increase of 51%; the number of private charging piles reached 5.87 million units, with a year-on-year increase of 69%. The operation of charging pile is mainly based on TELD, Star Charge, State Grid and YKC: As of the end of 2023, TELD accounts for 19%, Star Charge accounts for 17%, YKC accounts for 16%, and State Grid accounts for 7%.

In recent ten years, the registration number of charging pile-related enterprises in China basically showed a trend of year-by-year increase. Especially in 2021, the annual registration number increased by 80.9% to 64,000 on a year-on-year basis, reaching the peak growth rate of the past ten years. On this basis, in 2022, the registration number of charging pile-related enterprises in China increased by 43.9% to 92,000 on a year-on-year basis. In 2023, the registration number of charging pile-related enterprises in China exceeded 100,000 for the first time, with a year-on-year increase of 42.7% to 131,000, setting a new high in the past decade. As of August 2024, China had registered 89,000 charging pile-related enterprises in the year.

In terms of the existing enterprises, by August 2024, there were 473,000 charging pile-related enterprises in China. In terms of regional distribution, Guangdong currently has 54,100 charging pile-related enterprises, ranking first. Jiangsu and Henan follow with 40,100 and 33,200 charging pile-related enterprises, respectively, ranking second and third. Shandong, Zhejiang, Anhui, and other regions follow, with the number of related enterprises all below 30,000.

In August 2024, the National Energy Administration issued the “Implementation Plan for High-Quality Development Action of Distribution Network (2024-2027)”, which especially emphasized the importance of coordinated development of distribution network and electric vehicle charging facilities. This plan aims to promote the key provinces with large-scale development of electric vehicles to study the capacity of accessible charging facilities of the distribution network and guide the charging facilities to be reasonably connected to the medium and low voltage distribution network by establishing a sound mechanism. Meanwhile, the scheme and measures for expanding the access capacity and the clear time limit are proposed. This indicates that under the background of large-scale development of new energy vehicles and continuous favorable policies, the charging pile industry is expected to usher in a new stage of high-speed growth, thus providing power and direction for the high-quality development of power distribution network.

1.1.3 Advantageous conditions of project construction

(1) Policy advantages

In order to implement the “New Energy Vehicle Industry Development Plan (2021-2035)” (GBF [2020] No. 39), promote the infrastructure construction of Internet-connected cloud control, explore the multi-scene application of autonomous driving technology based on high-efficiency coordination of vehicle, road, network, cloud and image, and accelerate the technological breakthrough and industrialization development of intelligent connected vehicles.

The new energy vehicle purchase tax exemption policy from initial implementation to December 31, 2023 will be extended for 4 years, to December 31, 2027. Among them, from January 1, 2024, to December 31, 2025, vehicle purchase tax will be exempted, continuing the exemption for the next two years. From January 1, 2026, to December 31, 2027, vehicle purchase tax will be halved, and the reduced tax rate will apply in the subsequent two years. A policy extension has been implemented, with the total amount of vehicle purchase tax reduction and exemption expected to reach 520 billion yuan from 2024 to 2027.

According to the “Implementation Opinions of the National Development and Reform Commission and Other Departments on Further Improving the Service Guarantee Capacity of Electric Vehicle Charging Infrastructure”, the charging infrastructure is an important guarantee for the green travel of electric vehicle users, and an important support for promoting the development of new energy vehicle industry, promoting the construction of new electric power system and assisting the realization of the Carbon Peaking and Carbon Neutrality Goals. Encourage the promotion of intelligent and orderly charging, accelerate the innovation, testing, and standardization of vehicle-to-grid interaction technologies, and actively advance pilot demonstrations. Support the development of new technologies and models such as high-power charging, wireless charging, and autonomous unmanned charging.

(2) Location advantages

Wangqing County has obvious location advantages and well-developed transportation. Wangqing is located in the east of Jilin Province and the northeast of Yanbian Korean Autonomous Prefecture. The whole area is 108 kilometers long from north to south and 152 kilometers from east to west. Wangqing County is close to the Northeast Asian Economic and Trade Zone and is adjacent to the open cities of Suifenhe, Hunchun and Tumen, facing 8 ports, including Suifenhe, Changlingzi, Shatuozi, Tumen, Sanhe, Nanping and Shuangmufeng. With an area of 9,016 square kilometers, it is the second largest county at county level in the province.

Jilin Wangqing Economic Development Zone is located in the northeast of Yanbian Prefecture, at the intersection of Changchun-Jilin-Tumen Development and Opening-up Pilot Zone and Harbin-Mudanjiang-Suifenhe-Dongning Economic Belt of Heilongjiang Province, 77 kilometers away from Prefecture Capital Yanji, 55 kilometers away from Tumen Port and 121 kilometers away from Hunchun Port.

(3) Advantages of investment services

Wangqing Economic Development Zone has made remarkable achievements in attracting investment. Eight new projects have been launched, with a total investment of up to 830 million yuan, which has injected strong momentum into the local economic development. At the same time, 10 key investment attraction projects are being actively promoted, with a total expected investment of 1.52 billion yuan, highlighting the strong development momentum and enormous investment potential of the Wangqing Economic Development Zone.

Wangqing Economic Development Zone will continue to adhere to the strategy of “pay equal attention to Going out and Inviting in”, constantly expand investment channels, and strengthen cooperation and exchange with domestic and foreign enterprises and institutions. At the same time, further optimize the business environment, improve the service quality, and provide investors with more convenient, efficient and high-quality services. Through continuous efforts, Wangqing Economic Development Zone will attract more high-quality enterprises and projects to settle down and promote the local economy to achieve high-quality development.

1.2 Contents and scale of project construction

The project covers an area of 10,000 square meters, mainly including battery compartment, positive and negative liquid storage tanks, electrical system equipment and other facilities.

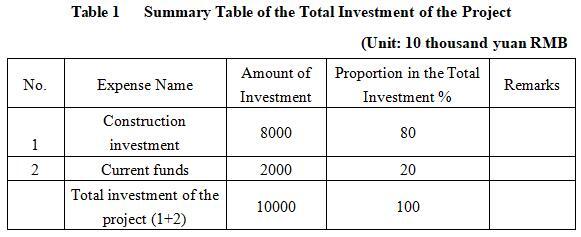

1.3. Total investment of the project and capital raising

The total investment of the project is 100 million yuan, including construction investment of 80 million yuan

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

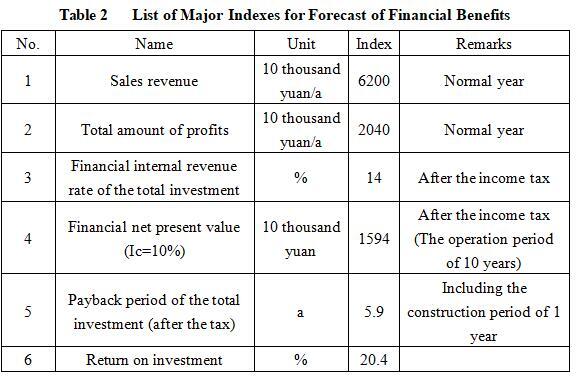

After the project reaches the production capacity, its annual sales income will be 62 million yuan, its profit will be 20.4 million yuan, its investment payback period will be 5.9 years (after the tax, including the construction period of 1 year) and its investment profit rate will be 20.4%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

The use of charging pile can significantly reduce carbon emissions and improve air quality. Electric vehicles, compared to traditional fuel-powered vehicles, generate almost no exhaust emissions, thus alleviating the impact of global climate change. Intelligent charging piles can also integrate renewable energy sources such as solar and wind power, further reducing dependence on fossil fuels and achieving “zero emissions”. The construction of the project will further enhance the development of the automotive parts industry in Wangqing County, drive the economic growth of surrounding areas, and promote industrial upgrades. In addition, the establishment of the Project will help solve employment issues, alleviate social employment conflicts, and ensure the stable development of the economy. The Project has strong profitability and anti-risk capability, with obvious social benefits.

1.5 Cooperative way

Sole proprietorship, joint venture and cooperation, etc.

1.6 What to be invested by the foreign party

Funds and other ways can be negotiated face to face.

1.7 Construction site of the project

Jilin Wangqing Economic Development Zone

1.8 Progress of the project

Project proposal has been prepared

2. Introduction to the Partner

2.1 Unit basic information

Name: Management Committee of Jilin Wangqing Economic Development Zone (former Wangqing Industrial Concentration Zone)

Address: No. 435-2, Binhe North Street, Wangqing County

2.2 Unit overview

Jilin Wangqing Economic Development Zone is located in the northeast of Yanbian Prefecture, at the intersection of Changchun-Jilin-Tumen Development and Opening-up Pilot Zone and Harbin-Mudanjiang-Suifenhe-Dongning Economic Belt of Heilongjiang Province, 77 kilometers away from Prefecture Capital Yanji, 55 kilometers away from Tumen Port and 121 kilometers away from Hunchun Port. The development zone was formerly known as the Wangqing County Industrial Concentration Zone. In November 2005, it was officially approved and established by the provincial government, with a planned land area of 3.22 square kilometers. In 2016, the zone was included in the national development zone directory. On December 23, 2022, it was upgraded to Jilin Wangqing Economic Development Zone with the approval of the provincial government.

Currently, there are 153 enterprises settled in the park, including 12 industrial enterprises above designated size. In 2022, Wangqing Economic Development Zone realized total industrial production value of 1.68 billion yuan, an added value of 602 million yuan, tax revenue of 149 million yuan, fixed asset investment of 872 million yuan, and a total import and export volume of 112 million yuan. In 2022, it ranked the 25th among 72 provincial level development zones in the province, placing it in the middle to upper range in terms of comprehensive strength.

Since its establishment, the development zone has adhered to the coordinated development of economy, resources and ecology. After years of layout, an ecological agricultural product processing industry represented by Haoji Brewing Food Co., Ltd, Zhongnong Industry and Beiyihe has been preliminarily formed; Edible mushroom processing industry, represented by Foison Bio-Tech and Beier Technology. Pharmaceutical and health industry, represented by Zhengshengkang Bio, Likang Pharmaceuticals, and Huahui Bio. Clean energy recycling economy industry represented by Kaidi Electric Power, Jingyu Bio-tech and Green Power Technology. During the “14th Five-Year Plan” period, it will focus on cultivating four leading industries: agricultural products processing industry, Health and wellness industry, clean energy industry and advanced manufacturing industry.

2.3 Contact method

Contact Person: Miao Yuqiang

Tel: +86-15143374377

Unit: Jilin Wangqing Economic Development Zone (formerly Wangqing Industrial Concentration Zone)

Email: wqkfzs@163.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Yanbian Prefecture Bureau of Commerce

Contact Person: Li Jingyu

Tel: +86-13596515933